Understanding the various types of loans available is crucial for making informed financial decisions, whether you’re looking to finance a home, fund a business venture, or cover unexpected expenses. With numerous loan options on the market, each with its unique characteristics and requirements, navigating the lending landscape can be overwhelming. This article aims to demystify the different types of loans, explaining their features, benefits, and typical uses to help borrowers choose the most suitable option for their needs. Various loan types cater to diverse financial situations and goals.

Understanding the Different Types of Loans Available

When it comes to borrowing money, there are various types of loans that cater to different needs and financial situations. Understanding the characteristics of each loan type is crucial to making informed decisions. The main types of loans are generally categorized based on their purpose, repayment terms, and the level of risk involved for both the lender and the borrower.

Secured vs. Unsecured Loans

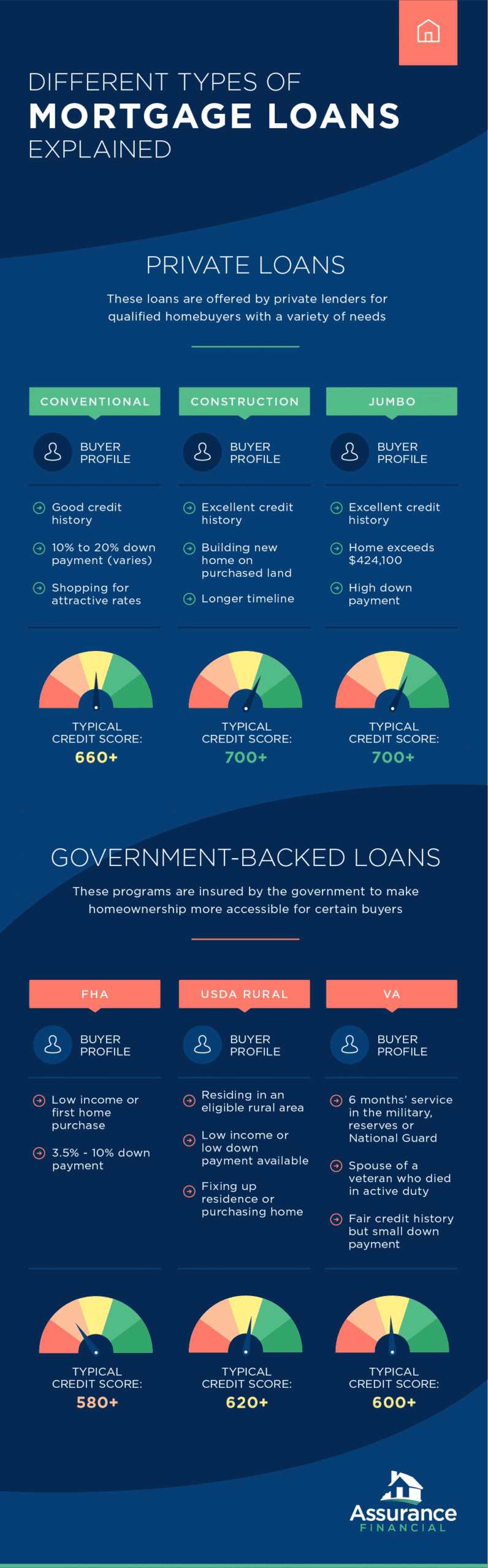

Secured loans require the borrower to provide collateral, which is an asset that the lender can seize if the borrower fails to repay the loan. This type of loan typically offers more favorable terms, such as lower interest rates, because the risk for the lender is reduced. On the other hand, unsecured loans do not require collateral, making them riskier for lenders, who consequently charge higher interest rates. Examples of secured loans include mortgages and auto loans, while personal loans and credit card debt are usually unsecured.

How to Qualify for a Loan

How to Qualify for a LoanShort-Term vs. Long-Term Loans

Loans can also be distinguished based on their repayment period. Short-term loans are designed to be repaid within a year or less and are often used to cover immediate or emergency expenses. These loans typically have higher interest rates due to their short repayment term. In contrast, long-term loans can have repayment periods spanning several years or even decades, such as mortgages. Long-term loans usually offer lower monthly payments but may cost more in interest over the life of the loan.

Specialized Loans

There are also specialized loans tailored for specific purposes, such as student loans for education expenses and business loans for entrepreneurial ventures. These loans often have unique features and benefits, such as deferred repayment options or tax benefits, designed to support the borrower’s specific needs.

| Loan Type | Description | Typical Use |

|---|---|---|

| Secured Loan | Requires collateral; generally has lower interest rates | Mortgages, Auto Loans |

| Unsecured Loan | No collateral required; typically has higher interest rates | Personal Loans, Credit Card Debt |

| Short-Term Loan | Repayment term is one year or less; often used for emergencies | Emergency expenses, temporary financial gaps |

| Long-Term Loan | Repayment term spans several years or decades; lower monthly payments | Mortgages, large purchases |

| Specialized Loan | Designed for specific purposes; may offer unique benefits | Student Loans, Business Loans |

Frequently Asked Questions

What are the main types of loans available?

There are several types of loans available, including personal loans, mortgages, auto loans, and student loans. Each type of loan has its own unique characteristics and requirements. Personal loans are unsecured and can be used for various purposes, while mortgages are secured by property and used for home purchases. Auto loans are used for vehicle purchases, and student loans are designed for education expenses.

Loan Repayment Strategies

Loan Repayment StrategiesHow do secured and unsecured loans differ?

Secured loans require collateral, such as property or assets, to secure the loan. If the borrower defaults, the lender can seize the collateral to recoup losses. Unsecured loans, on the other hand, do not require collateral and are based on the borrower’s creditworthiness. Unsecured loans typically have higher interest rates and stricter repayment terms. Examples of secured loans include mortgages and auto loans, while personal loans and credit cards are often unsecured.

What is the difference between fixed-rate and variable-rate loans?

Fixed-rate loans have an interest rate that remains constant throughout the loan term, providing predictable monthly payments. Variable-rate loans, also known as adjustable-rate loans, have an interest rate that can fluctuate based on market conditions. Variable-rate loans may offer lower initial interest rates, but the rate can increase or decrease over time, affecting monthly payments.

How do loan repayment terms affect the total cost?

Loan repayment terms can significantly impact the total cost of the loan. Longer repayment terms may result in lower monthly payments, but the borrower will pay more in interest over the life of the loan. Shorter repayment terms typically have higher monthly payments, but the total interest paid is lower. Borrowers should carefully consider their financial situation and choose a repayment term that balances affordability and total cost.

Impact of Loans on Credit Score

Impact of Loans on Credit Score