Refinancing a loan can be a strategic financial move, allowing individuals to take advantage of lower interest rates, reduce monthly payments, or tap into their home’s equity. With various refinancing loan options available, borrowers can choose the one that best suits their financial goals and circumstances. From rate-and-term refinancing to cash-out refinancing, understanding the different types of refinancing options is crucial to making an informed decision. This article will explore the various refinancing loan options, their benefits, and how to determine which one is right for you, helping you navigate the refinancing process with confidence and achieve your financial objectives.

Exploring Refinancing Loan Options

Refinancing a loan can be a strategic financial move for individuals and businesses alike, offering the potential to lower monthly payments, reduce interest rates, or tap into home equity. When considering refinancing, it’s crucial to understand the various loan options available, as each comes with its own set of benefits and drawbacks. The process involves replacing an existing loan with a new one, typically with different terms. This can be particularly beneficial in a changing financial landscape or when personal financial circumstances shift.

Types of Refinancing Loans

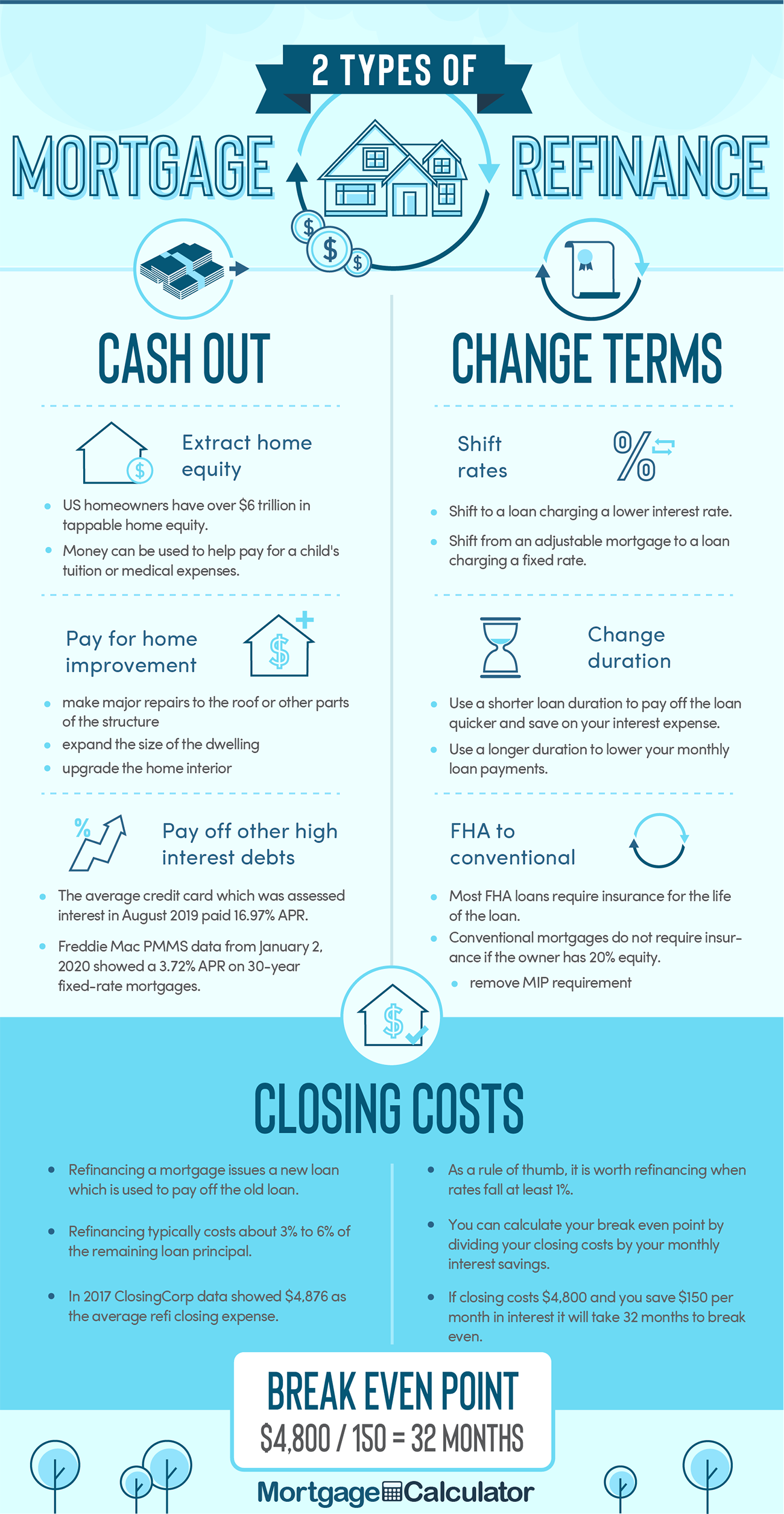

There are several types of refinancing loans available, catering to different needs and financial situations. These include rate-and-term refinancing, which involves changing the interest rate, loan term, or both, without advancing new money. Another option is cash-out refinancing, where the borrower takes out a new loan for more than they owe on the existing loan, receiving the difference in cash. This can be a useful way to access funds for major expenses or debt consolidation.

Benefits of Refinancing

The benefits of refinancing can be substantial, depending on the circumstances. One of the primary advantages is the potential to secure a lower interest rate, which can significantly reduce monthly payments and the total cost of the loan over its lifetime. Refinancing can also provide an opportunity to switch from an adjustable-rate mortgage to a fixed-rate loan, offering more stability and predictability in financial planning.

Considerations Before Refinancing

Before deciding to refinance, it’s essential to consider several factors carefully. These include the costs associated with refinancing, such as origination fees, appraisal fees, and closing costs, which can add up. Borrowers should also assess their credit score, as a good credit score can help secure more favorable loan terms. Additionally, understanding the loan-to-value ratio and how it impacts refinancing options is crucial.

Types of Loans Explained

Types of Loans Explained| Refinancing Option | Description | Benefits |

|---|---|---|

| Rate-and-Term Refinancing | Changing the interest rate or loan term without advancing new money. | Lower monthly payments, reduced interest rate. |

| Cash-Out Refinancing | Taking out a new loan for more than owed on the existing loan, receiving the difference in cash. | Access to cash for expenses or debt consolidation. |

| Consolidation Refinancing | Combining multiple loans into a single loan with a lower interest rate and single monthly payment. | Simplified finances, potentially lower interest rate. |

Exploring Refinancing Loan Options: A Comprehensive Guide

Refinancing a loan can be a strategic financial decision that involves replacing an existing loan with a new one that has a lower interest rate, better terms, or a different repayment period. This process can help individuals or businesses to reduce their monthly payments, tap into the equity of their assets, or switch from a variable to a fixed-rate loan, thereby achieving greater financial stability and flexibility.

Understanding Refinancing Types

There are several types of refinancing options available, including rate-and-term refinancing, which involves changing the interest rate or the repayment term of the loan, and cash-out refinancing, which allows borrowers to tap into the equity of their property by borrowing more than they owe on the existing loan.

Benefits of Refinancing

The benefits of refinancing include reducing monthly payments by securing a lower interest rate, simplifying finances by consolidating multiple loans into one, and accessing cash by tapping into the equity of an asset. Refinancing can also provide an opportunity to switch from a variable to a fixed-rate loan, thereby reducing the risk associated with fluctuating interest rates.

Eligibility Criteria for Refinancing

To be eligible for refinancing, borrowers typically need to meet certain criteria, including having a good credit score, a stable income, and a reasonable loan-to-value ratio. Lenders may also consider the borrower’s debt-to-income ratio and their overall financial history when evaluating their eligibility for refinancing.

Refinancing Loan Options for Different Assets

Refinancing options are available for various types of assets, including mortgages, auto loans, and student loans. Each type of asset has its own set of refinancing options and requirements, and borrowers should carefully consider their options before making a decision.

How to Qualify for a Loan

How to Qualify for a LoanPotential Risks and Considerations

While refinancing can be a beneficial financial strategy, it also involves certain risks and considerations, including the potential for prepayment penalties, closing costs, and the risk of extending the repayment period, which can result in paying more in interest over the life of the loan.

Frequently Asked Questions

What are the benefits of refinancing my loan?

Refinancing your loan can help you save money by reducing your monthly payments or lowering your interest rate. You can also switch from an adjustable-rate to a fixed-rate loan, or tap into your home’s equity to fund large expenses. Additionally, refinancing can simplify your finances by consolidating multiple loans into one.

How do I qualify for a refinance loan?

To qualify for a refinance loan, you’ll typically need a good credit score, a stable income, and a reasonable debt-to-income ratio. You’ll also need to have sufficient equity in your property. Lenders will review your credit history, income, and other financial factors to determine your eligibility. You may also need to provide documentation, such as pay stubs and tax returns.

What are the different types of refinance loan options?

There are several types of refinance loan options available, including rate-and-term refinance, cash-out refinance, and cash-in refinance. A rate-and-term refinance allows you to change the interest rate or loan term, while a cash-out refinance lets you tap into your home’s equity. A cash-in refinance involves paying down the loan balance to secure a better interest rate.

How long does it take to refinance a loan?

The time it takes to refinance a loan can vary depending on the lender and the complexity of the transaction. On average, the refinance process can take anywhere from 30 to 60 days. This includes the time it takes to process your application, order an appraisal, and close the loan. Some lenders may offer expedited processing options for an additional fee.

Loan Repayment Strategies

Loan Repayment Strategies