Managing loan repayments effectively is crucial for financial stability. With various loan options available, borrowers must navigate the complexities of repayment to avoid debt traps. A well-planned loan repayment strategy can help individuals pay off debts efficiently, reduce financial stress, and achieve long-term financial goals. This article explores different loan repayment strategies, providing insights into the most effective methods for tackling debt, and offers practical advice on selecting the best approach based on individual financial circumstances and loan types. Effective loan repayment planning is key to financial freedom.

Effective Loan Repayment Strategies to Pay Off Debt Faster

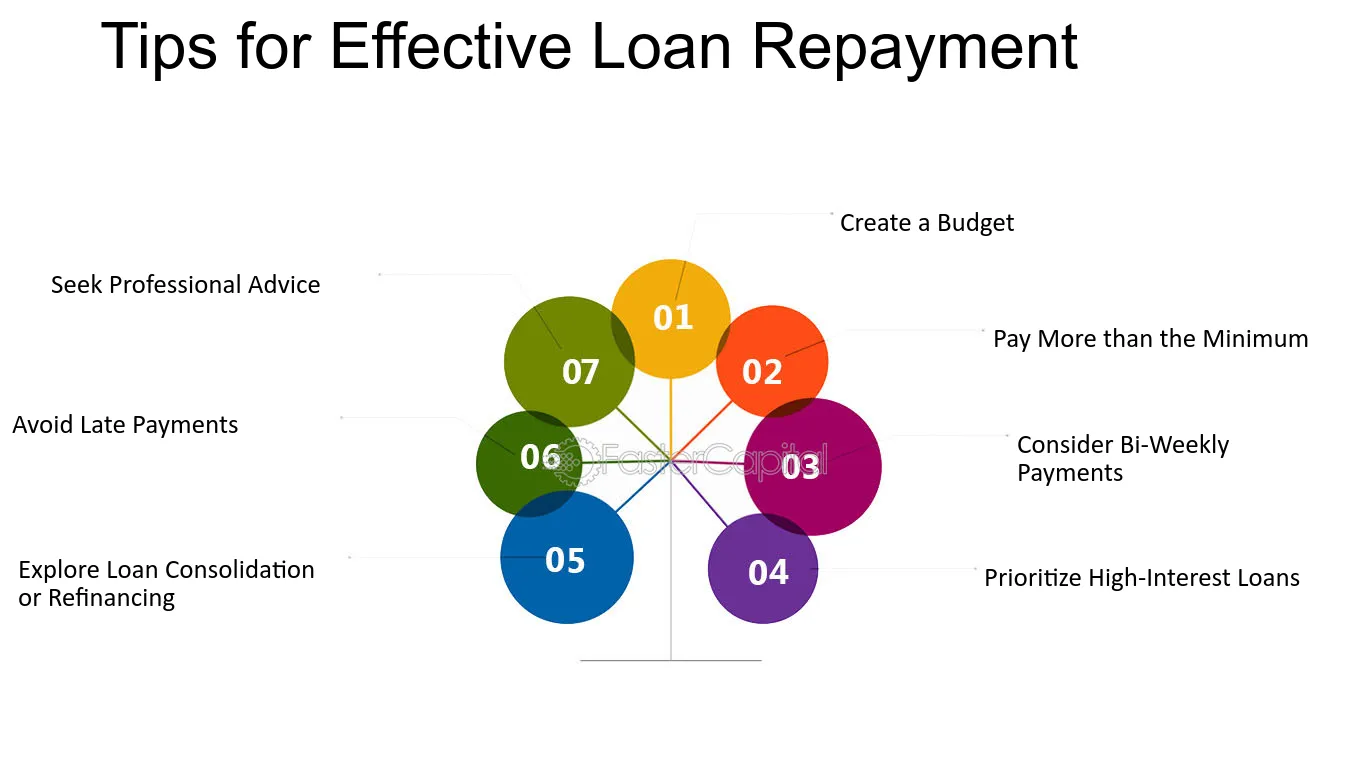

Paying off debt can be a daunting task, but with the right loan repayment strategies, individuals can save money on interest and become debt-free faster. It’s essential to understand the various options available and choose the one that best suits your financial situation.

Understanding Your Loan Options

When it comes to loan repayment, it’s crucial to understand the terms of your loan, including the interest rate, loan term, and any fees associated with the loan. By knowing these details, you can make informed decisions about your repayment strategy. For instance, if you have a loan with a high interest rate, you may want to prioritize paying off that loan first to save money on interest over time.

Impact of Loans on Credit Score

Impact of Loans on Credit ScorePopular Loan Repayment Methods

There are several popular loan repayment methods that individuals can consider, including the Snowball Method and the Avalanche Method. The Snowball Method involves paying off loans with the smallest balances first, while making minimum payments on other loans. In contrast, the Avalanche Method prioritizes loans with the highest interest rates, which can save individuals more money on interest over time.

Creating a Personalized Repayment Plan

To create an effective loan repayment plan, individuals should consider their income, expenses, and financial goals. By assessing these factors, individuals can determine how much they can afford to pay each month and create a plan that works for them. It’s also essential to consider any prepayment penalties or fees associated with paying off a loan early.

| Repayment Strategy | Description | Benefits |

|---|---|---|

| Snowball Method | Pay off loans with the smallest balances first | Provides a psychological boost as you quickly pay off smaller loans |

| Avalanche Method | Pay off loans with the highest interest rates first | Saves you more money on interest over time |

| Debt Consolidation | Combine multiple loans into a single loan with a lower interest rate | Simplifies your payments and can save you money on interest |

Frequently Asked Questions

What are the most effective loan repayment strategies?

Effective loan repayment strategies include the snowball method, avalanche method, and debt consolidation. The snowball method involves paying off smaller loans first, while the avalanche method prioritizes loans with higher interest rates. Debt consolidation combines multiple loans into one with a lower interest rate and a single monthly payment. These strategies help individuals manage their debt and make timely payments.

Refinancing Loan Options

Refinancing Loan OptionsHow does the snowball method work for loan repayment?

The snowball method involves listing all loans from smallest to largest and paying the minimum on all but the smallest. The smallest loan is paid off as aggressively as possible until it’s eliminated. Once the smallest loan is paid, the process is repeated with the next smallest, and so on. This method provides a psychological boost as smaller loans are quickly paid off, helping to build momentum in the debt repayment process.

What are the benefits of using the avalanche method for loan repayment?

The avalanche method saves money by prioritizing loans with the highest interest rates. By paying off high-interest loans first, individuals can reduce the total interest paid over time. This method is particularly effective for those with multiple loans with varying interest rates. It can lead to significant savings and is a strategic approach to managing debt.

Can debt consolidation simplify loan repayment?

Debt consolidation simplifies loan repayment by combining multiple loans into a single loan with a lower interest rate and one monthly payment. This can reduce financial stress and make it easier to manage debt. Consolidation can also potentially lower monthly payments and reduce the total interest paid. It’s an effective strategy for those with multiple loans and can help individuals stay on track with their debt repayment goals.

Types of Loans Explained

Types of Loans Explained