The relationship between loans and credit scores is a complex one, with various factors at play. When an individual takes out a loan, it can have both positive and negative effects on their credit score, depending on their repayment history and other considerations. A good credit score is essential for securing future loans and credit at favorable interest rates. Understanding how loans impact credit scores is crucial for making informed financial decisions. This article will examine the various ways in which loans can influence an individual’s credit score, highlighting key factors to consider.

Understanding the Impact of Loans on Your Credit Score

The impact of loans on your credit score is a multifaceted issue that involves various factors, including the type of loan, payment history, credit utilization, and the overall credit mix. When you take out a loan, it can have both positive and negative effects on your credit score, depending on how you manage it. A well-managed loan can contribute to a healthy credit score, while a poorly managed one can lead to a decline in your creditworthiness.

Payment History and Credit Score

Payment history is a significant component of your credit score, accounting for a substantial percentage of the total score. When you take out a loan, making timely payments is crucial to maintaining or improving your credit score. Late payments or defaults can significantly lower your credit score, making it harder to secure future credit at favorable terms. On the other hand, a consistent payment history can boost your credit score over time.

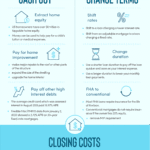

Refinancing Loan Options

Refinancing Loan Options| Payment Status | Impact on Credit Score |

|---|---|

| On-time payments | Positive impact, potentially increasing credit score |

| Late payments | Negative impact, potentially decreasing credit score |

| Defaults | Significant negative impact, potentially leading to a substantial decrease in credit score |

Credit Utilization and Loan Impact

Credit utilization is another critical factor in determining your credit score. When you take out a loan, it can affect your credit utilization ratio, which is the percentage of available credit being used. A high credit utilization ratio can negatively impact your credit score, while a lower ratio can have a positive effect. Managing your credit utilization effectively by keeping it below a certain threshold (e.g., below 30%) is essential for maintaining a healthy credit score.

| Credit Utilization Ratio | Impact on Credit Score |

|---|---|

| Below 30% | Positive impact, potentially increasing credit score |

| 30% to 50% | Neutral to slightly negative impact |

| Above 50% | Negative impact, potentially decreasing credit score |

Loan Types and Credit Mix

The type of loan you take out and your overall credit mix can also influence your credit score. A diverse credit mix that includes different types of credit, such as installment loans and revolving credit, can positively impact your credit score. This diversity demonstrates your ability to manage different types of credit responsibly. On the other hand, having too many loans of the same type or applying for multiple loans in a short period can negatively affect your credit score.

| Credit Mix | Impact on Credit Score |

|---|---|

| Diverse credit mix | Positive impact, potentially increasing credit score |

| Limited credit mix | Neutral to slightly negative impact |

| Multiple loan applications | Negative impact, potentially decreasing credit score |

Frequently Asked Questions

How do loans affect my credit score?

Loans can significantly impact your credit score, either positively or negatively. Timely repayments can boost your credit score by demonstrating responsible credit behavior. Conversely, late or missed payments can harm your credit score. The loan type and amount also play a role, with large loans or multiple loans potentially affecting your credit utilization ratio and overall credit health.

Types of Loans Explained

Types of Loans ExplainedCan a single late payment on a loan ruin my credit score?

A single late payment can negatively affect your credit score, but the extent of the damage depends on your overall credit history and the loan type. If you have a good credit history, a one-time late payment may not drastically lower your score. However, if you’re already struggling with credit issues, a late payment can further decrease your score.

How long does a loan stay on my credit report?

The duration a loan remains on your credit report varies depending on the loan type and repayment status. Generally, a paid-off loan remains on your report for 10 years from the date it was closed. Unpaid or defaulted loans can stay on your report for 7 years from the date of the first missed payment.

Can paying off a loan early improve my credit score?

Paying off a loan early can positively impact your credit score by demonstrating responsible credit behavior. However, the effect may be more significant if you’re paying off a loan with a high balance or high interest rate. Additionally, paying off a loan early can also reduce your credit utilization ratio, which can further improve your credit score.

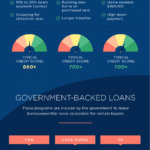

How to Qualify for a Loan

How to Qualify for a Loan