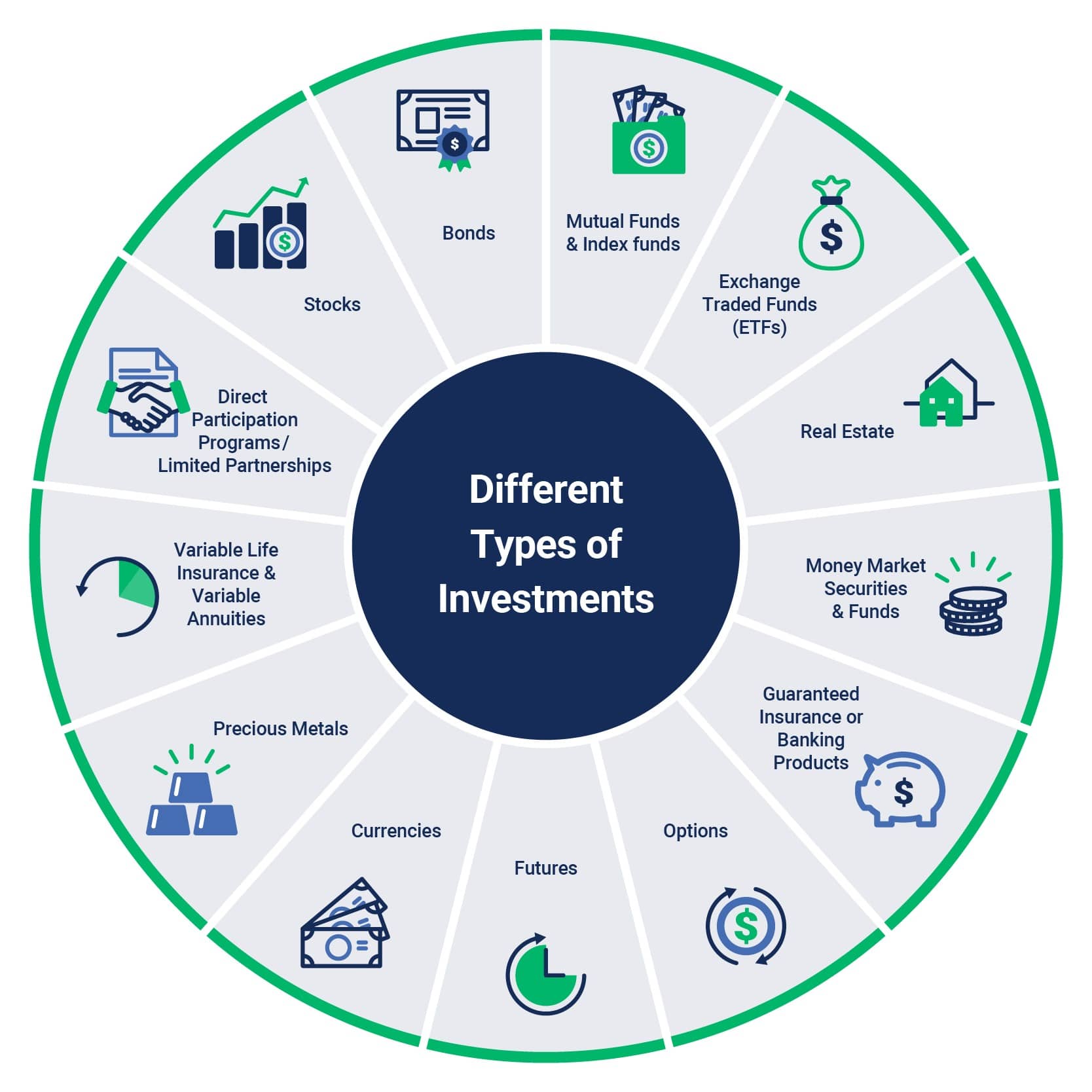

Investing is a crucial aspect of personal finance, allowing individuals to grow their wealth over time. With numerous options available, understanding the different types of investments is essential for making informed decisions. Various investment vehicles cater to distinct risk tolerance levels, financial goals, and time horizons. From traditional assets like stocks and bonds to alternative investments such as real estate and commodities, the array of choices can be overwhelming. This article aims to provide an overview of the primary types of investments, helping readers navigate the complex world of investing and make strategic decisions to achieve their financial objectives.

Types of Investments

When it comes to investing, there are numerous options available, each with its own unique characteristics, benefits, and risks. Understanding the different types of investments is crucial for making informed decisions that align with your financial goals and risk tolerance. Investments can be broadly categorized into various asset classes, including stocks, bonds, real estate, and more. The key is to diversify your portfolio by allocating your investments across different asset classes to minimize risk and maximize returns.

Stock Investments

Stock investments involve buying shares of companies with the potential for long-term growth. Stocks are considered a high-risk, high-reward investment, as their value can fluctuate significantly based on the company’s performance and market conditions. Investors can earn returns through dividend payments and capital appreciation. Stocks are often considered a cornerstone of many investment portfolios due to their potential for significant long-term growth.

Fixed-Income Investments

Fixed-income investments, such as bonds and treasury bills, offer a relatively stable source of returns in the form of regular interest payments. These investments are generally considered lower risk compared to stocks, as they typically offer a fixed rate of return and a relatively higher level of capital preservation. However, the returns on fixed-income investments may be lower than those from other asset classes, and they are not entirely immune to risks such as interest rate risk and credit risk.

Alternative Investments

Alternative investments encompass a broad range of assets beyond traditional stocks and bonds, including real estate, commodities, and private equity. These investments can provide a diversification benefit to a portfolio by introducing assets that are not closely correlated with the broader market. Alternative investments can offer attractive returns, but they often come with higher fees and liquidity risks, making them more suitable for sophisticated investors with a higher risk tolerance.

Risk Management Strategies

Risk Management Strategies| Investment Type | Risk Level | Potential Returns | Liquidity |

|---|---|---|---|

| Stocks | High | High | High |

| Bonds | Low to Medium | Low to Medium | Medium |

| Real Estate | Medium to High | Medium to High | Low |

| Commodities | High | High | High |

Understanding Various Investment Options

Investing is a crucial aspect of managing one’s finances, and there are numerous investment vehicles available, each with its unique characteristics, benefits, and risks. The diverse range of investment options allows individuals to choose those that best align with their financial goals, risk tolerance, and investment horizon.

Stocks and Equity Investments

Stocks represent ownership in companies, offering the potential for long-term growth. Investors can buy and sell stocks on stock exchanges, and the value of their investments can fluctuate based on the company’s performance and market conditions.

Bonds and Fixed-Income Investments

Bonds are debt securities issued by companies or governments to raise capital. They offer regular interest payments and the return of principal at maturity, making them a relatively stable investment option, although they carry credit risk and interest rate risk.

Real Estate Investments

Investing in real estate involves buying, owning, and managing properties, which can generate rental income and potentially appreciate in value over time. Real estate investments can be made directly through property purchases or indirectly through real estate investment trusts (REITs).

Mutual Funds and Diversified Portfolios

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer a convenient way to achieve diversification, reducing risk and potentially increasing returns, as they are managed by professional investment managers.

How to Build a Portfolio

How to Build a PortfolioAlternative Investments

Alternative investments, such as hedge funds, private equity, and commodities, offer a way to diversify a portfolio beyond traditional assets. These investments often involve higher risks and may require significant minimum investments, but they can also provide unique return opportunities.

Frequently Asked Questions

What are the different types of investments available?

There are various types of investments, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), real estate, and commodities. Each type has its own characteristics, benefits, and risks. Stocks represent ownership in companies, while bonds are debt securities. Mutual funds and ETFs offer diversified portfolios, and real estate involves investing in property. Commodities include investments in gold, oil, and other natural resources.

How do I choose the right investment for my financial goals?

To choose the right investment, consider your financial goals, risk tolerance, and time horizon. Assess your investment objectives, such as capital appreciation or income generation. Evaluate your risk tolerance and ability to withstand market fluctuations. Consider your investment horizon and liquidity needs. Diversify your portfolio by allocating assets across different investment types to minimize risk and maximize returns.

What are the benefits of diversifying my investment portfolio?

Diversifying your investment portfolio helps manage risk and increase potential returns. By spreading investments across different asset classes, you reduce dependence on a single investment. This can help mitigate losses during market downturns. Diversification also provides opportunities for growth, as different investments perform well at different times. A diversified portfolio can help you achieve your long-term financial goals.

Are there any low-risk investment options available?

Yes, there are low-risk investment options available, such as bonds, money market funds, and certificates of deposit (CDs). These investments typically offer lower returns but are generally more stable and less volatile. Bonds issued by credible governments or companies are considered low-risk, while money market funds invest in low-risk, short-term debt securities. CDs are time deposits offered by banks with fixed interest rates and maturity dates.

Investment Trends 2025

Investment Trends 2025