Effective risk management is crucial for organizations to navigate complex and ever-changing business environments. Implementing robust risk management strategies enables companies to identify, assess, and mitigate potential threats, minimizing their impact on operations and reputation. A well-structured risk management framework allows businesses to make informed decisions, capitalize on opportunities, and maintain a competitive edge. By adopting proactive risk management approaches, organizations can reduce uncertainty, enhance resilience, and drive long-term sustainability, ultimately contributing to their overall success and growth in an increasingly volatile marketplace.

Effective Risk Management Strategies for Business Success

In today’s fast-paced and ever-changing business landscape, Risk Management has become an essential component of any successful organization. Effective risk management strategies enable businesses to identify, assess, and mitigate potential risks that could impact their operations, finances, and reputation. By adopting a proactive approach to risk management, organizations can minimize losses, maximize opportunities, and achieve their strategic objectives.

Identifying and Assessing Risks

The first step in developing a risk management strategy is to identify and assess potential risks. This involves analyzing the organization’s internal and external environment to identify potential threats and opportunities. Risk assessment involves evaluating the likelihood and potential impact of each identified risk, and prioritizing them based on their level of severity. This helps organizations to focus on the most critical risks and develop effective mitigation strategies.

How to Build a Portfolio

How to Build a PortfolioDeveloping Risk Mitigation Strategies

Once risks have been identified and assessed, organizations can develop risk mitigation strategies to minimize their impact. Risk mitigation involves implementing controls or measures to reduce the likelihood or impact of a risk. This can include strategies such as risk avoidance, risk transfer, risk reduction, and risk acceptance. For example, an organization may choose to transfer risk through insurance or outsourcing, or reduce risk through the implementation of new policies or procedures.

Monitoring and Reviewing Risk Management Strategies

Risk management is an ongoing process that requires continuous monitoring and review. Risk monitoring involves regularly reviewing and updating risk assessments to ensure that they remain relevant and effective. This helps organizations to identify new risks, assess the effectiveness of existing mitigation strategies, and make adjustments as needed. By regularly monitoring and reviewing risk management strategies, organizations can ensure that they remain proactive and effective in managing risk.

| Risk Management Strategy | Description | Benefits |

|---|---|---|

| Risk Avoidance | Avoiding activities or decisions that could lead to risk | Eliminates risk, reduces potential losses |

| Risk Transfer | Transferring risk to another party through insurance or outsourcing | Reduces financial impact, shares risk with others |

| Risk Reduction | Implementing controls or measures to reduce risk | Reduces likelihood or impact of risk, minimizes losses |

Frequently Asked Questions

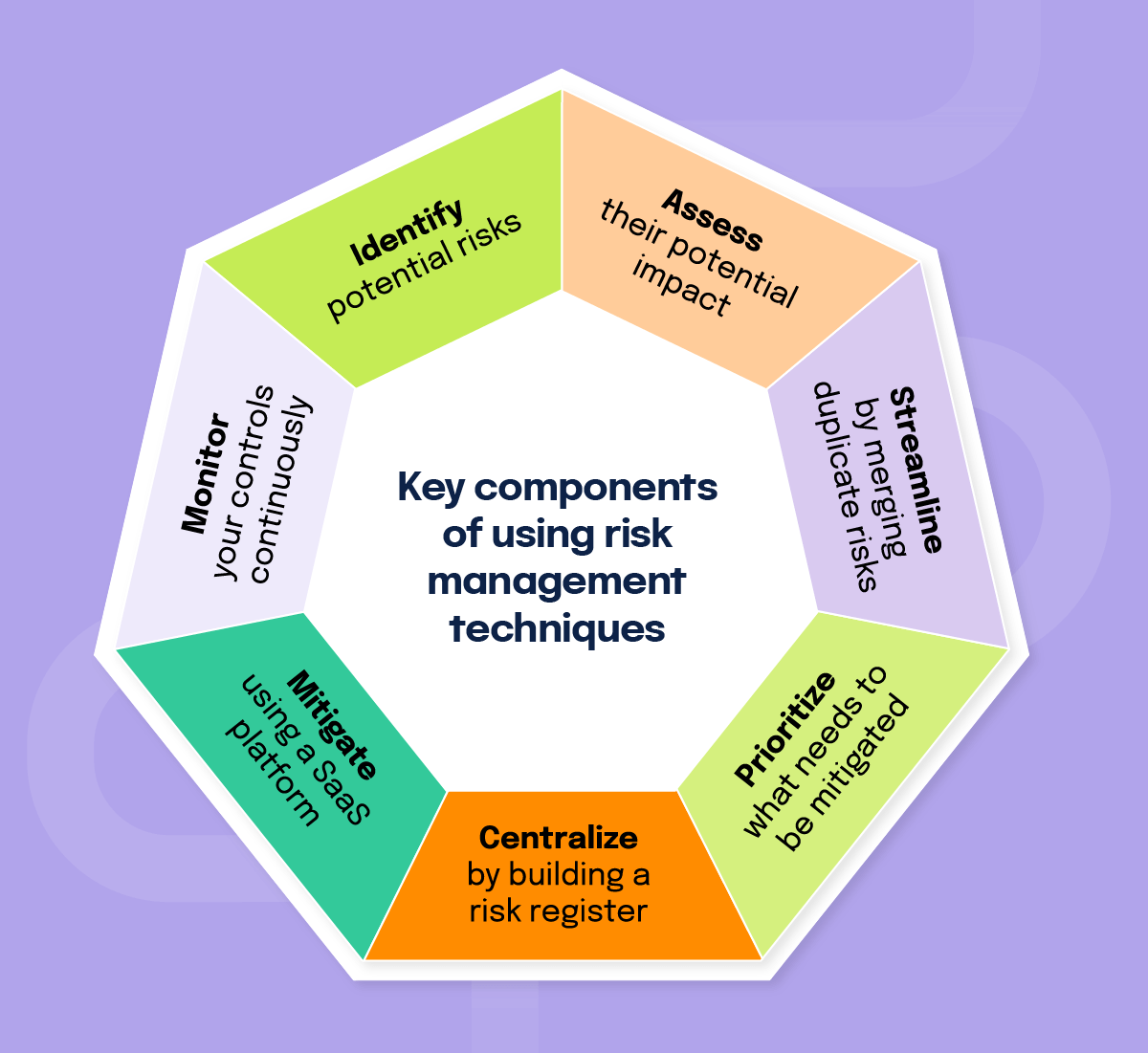

What are the key components of a risk management strategy?

A risk management strategy involves identifying, assessing, and mitigating potential risks. Key components include risk identification, risk assessment, risk prioritization, and risk mitigation. This involves analyzing potential risks, evaluating their likelihood and impact, and implementing measures to minimize or eliminate them. Effective risk management strategies also involve ongoing monitoring and review to ensure their continued relevance and effectiveness.

Investment Trends 2025

Investment Trends 2025How do you prioritize risks in a risk management strategy?

Prioritizing risks involves evaluating their likelihood and potential impact. This is typically done using a risk matrix, which categorizes risks based on their likelihood and potential impact. Risks that are deemed high likelihood and high impact are prioritized first, while those that are low likelihood and low impact are prioritized last. This ensures that the most critical risks are addressed first, and resources are allocated effectively to mitigate them.

What are some common risk management strategies?

Common risk management strategies include risk avoidance, risk transfer, risk mitigation, and risk acceptance. Risk avoidance involves eliminating or avoiding activities that give rise to risk. Risk transfer involves transferring risk to another party, such as through insurance. Risk mitigation involves reducing the likelihood or impact of a risk. Risk acceptance involves accepting a risk and doing nothing to mitigate it, often because the cost of mitigation outweighs the potential benefits.

How do you monitor and review a risk management strategy?

Monitoring and reviewing a risk management strategy involves regularly assessing its effectiveness and relevance. This includes tracking key risk indicators, reviewing risk assessments, and updating risk mitigation measures as necessary. It also involves identifying new risks and revising the risk management strategy to address them. Regular review and update ensure that the risk management strategy remains effective and aligned with changing circumstances.

Basics of Investing

Basics of Investing