As the global economy continues to evolve, investors are bracing for a new wave of opportunities and challenges in 2025. Emerging technologies, shifting market dynamics, and changing regulatory landscapes are expected to drive investment trends in the coming year. From sustainable investing to digital assets, investors are seeking to capitalize on growth areas while managing risk. This article will explore the key investment trends shaping the market in 2025, providing insights into the sectors and strategies that are likely to yield returns and drive long-term value creation. Understanding these trends is crucial for investors.

Emerging Investment Trends to Watch in 2025

As we approach 2025, the investment landscape is expected to be shaped by various factors, including technological advancements, shifting investor preferences, and global economic trends. Investors are likely to focus on opportunities that offer sustainable growth, diversification, and resilience in the face of uncertainty. Understanding the emerging investment trends is crucial for making informed decisions and achieving long-term financial goals.

Sustainable Investing on the Rise

Sustainable investing is gaining momentum as investors increasingly prioritize Environmental, Social, and Governance (ESG) considerations. This trend is driven by growing awareness of climate change, social inequality, and corporate governance issues. As a result, investments in renewable energy, green technologies, and socially responsible companies are expected to surge in 2025.

Basics of Investing

Basics of Investing| Sustainable Investment Themes | Key Areas of Focus |

|---|---|

| Renewable Energy | Solar, Wind, and Hydro power |

| Green Technologies | Energy Efficiency, Sustainable Infrastructure |

| Socially Responsible Investing | Diversity and Inclusion, Labor Practices |

Technological Innovations Driving Investment

Technological innovations are transforming the investment landscape, with Artificial Intelligence (AI), Blockchain, and Internet of Things (IoT) being key drivers of growth. These technologies are creating new opportunities for investors, from fintech and digital payments to cybersecurity and data analytics.

| Technological Innovations | Investment Opportunities |

|---|---|

| Artificial Intelligence | AI-powered finance, Machine Learning |

| Blockchain | Cryptocurrencies, Supply Chain Management |

| Internet of Things | Smart Homes, Industrial Automation |

Shifting Investor Preferences and Global Trends

Investor preferences are shifting towards alternative assets, such as private equity, real estate, and infrastructure. Global economic trends, including trade policies and monetary policies, are also influencing investment decisions. As a result, investors are seeking diversified portfolios that can navigate the complexities of the global economy.

| Alternative Assets | Key Characteristics |

|---|---|

| Private Equity | Long-term investment horizon, active management |

| Real Estate | Tangible assets, rental income |

| Infrastructure | Long-term contracts, stable cash flows |

Frequently Asked Questions

What are the top investment trends expected in 2025?

The top investment trends expected in 2025 include sustainable investing, technological innovation, and emerging market growth. Investors are shifting towards environmentally conscious investments and companies that prioritize ESG factors. Technological advancements in AI, blockchain, and renewable energy are also attracting significant investment. Emerging markets, particularly in Asia and Africa, are expected to experience substantial growth, making them attractive investment opportunities.

Types of Investments

Types of InvestmentsHow will sustainable investing shape the investment landscape in 2025?

Sustainable investing is anticipated to continue its upward trend in 2025, driven by increasing awareness of environmental and social issues. Investors are incorporating ESG considerations into their decision-making processes, leading to a shift towards more sustainable and responsible investments. This trend is expected to drive growth in industries such as renewable energy, clean technology, and eco-friendly products, ultimately shaping the investment landscape.

What role will technology play in investment trends in 2025?

Technology is expected to play a significant role in investment trends in 2025, with advancements in AI, blockchain, and fintech driving innovation. Investors are likely to focus on companies that leverage these technologies to improve efficiency, reduce costs, and enhance customer experiences. Emerging technologies such as quantum computing and 5G are also expected to attract investment, as they have the potential to disrupt traditional industries and create new opportunities.

How can investors capitalize on emerging market growth in 2025?

Investors can capitalize on emerging market growth in 2025 by diversifying their portfolios to include assets from regions such as Asia and Africa. These markets are expected to experience significant economic growth, driven by factors such as urbanization, technological adoption, and increasing consumer demand. Investors can access emerging markets through various investment vehicles, including ETFs, mutual funds, and individual stocks, allowing them to tap into the growth potential of these regions.

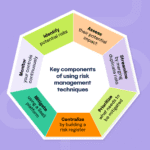

Risk Management Strategies

Risk Management Strategies