Investing is a crucial aspect of personal finance that enables individuals to grow their wealth over time. For those new to investing, understanding the basics is essential to making informed decisions. Investing involves putting money into assets that have a potential for growth, income, or both. It requires a clear understanding of various investment options, risk tolerance, and financial goals. By grasping these fundamental concepts, individuals can create a solid foundation for their investment strategy, helping them navigate the complexities of the financial markets and work towards achieving their long-term financial objectives.

Understanding the Fundamentals of Investing

Investing is a crucial aspect of personal finance that involves putting your money into assets that have a potential for growth, income, or both. It’s essential to understand the basics of investing to make informed decisions about your financial resources. Investing can help you achieve long-term financial goals, such as saving for retirement, a down payment on a house, or your children’s education.

Setting Financial Goals

Before you start investing, it’s vital to define your financial goals and risk tolerance. This involves identifying what you want to achieve through investing, how much you can afford to invest, and how long you can keep your money invested. Your financial goals will help guide your investment decisions and ensure that you’re investing in assets that align with your objectives. For instance, if you’re saving for a short-term goal, you may want to consider low-risk investments such as money market funds or short-term bonds.

Types of Investment Assets

There are various types of investment assets to choose from, including stocks, bonds, real estate, and commodities. Each asset class has its unique characteristics, benefits, and risks. Stocks offer the potential for long-term growth, while bonds provide regular income. Real estate investing can provide rental income and potential long-term appreciation in property value. Commodities, such as gold and oil, can provide a hedge against inflation and market volatility.

Investment Strategies

There are several investment strategies to consider, including dollar-cost averaging, diversification, and long-term investing. Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. Diversification involves spreading your investments across different asset classes to minimize risk. Long-term investing involves holding onto your investments for an extended period, which can help you ride out market fluctuations and capture long-term growth.

Types of Investments

Types of Investments| Investment Asset | Risk Level | Potential Return |

|---|---|---|

| Stocks | High | High |

| Bonds | Low to Medium | Low to Medium |

| Real Estate | Medium to High | Medium to High |

| Commodities | High | High |

Understanding Investment Fundamentals

Investing is a crucial aspect of securing one’s financial future, and it involves making informed decisions about where to allocate one’s resources. To make sound investment decisions, it is essential to grasp the basics of investing, including the various types of investments, risk management, and the importance of diversification.

Types of Investments

There are several types of investments available, including stocks, bonds, mutual funds, and real estate. Each type of investment has its unique characteristics, benefits, and risks. For instance, stocks offer the potential for long-term growth, while bonds provide a relatively stable source of income.

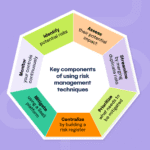

Risk Management

Risk management is a critical component of investing, as it involves identifying and mitigating potential risks that could impact one’s investments. Investors can manage risk by diversifying their portfolios, investing in assets with different risk profiles, and using hedging strategies.

Diversification

Diversification is a key investment principle that involves spreading one’s investments across different asset classes to minimize risk. By diversifying their portfolios, investors can reduce their exposure to any one particular investment and increase their potential for long-term returns.

Investment Strategies

There are various investment strategies that investors can use to achieve their financial goals. These include long-term investing, dollar-cost averaging, and value investing. Each strategy has its unique benefits and risks, and investors should carefully consider their options before making a decision.

Risk Management Strategies

Risk Management StrategiesInvestment Vehicles

Investment vehicles, such as exchange-traded funds (ETFs) and index funds, offer investors a convenient way to access different markets and asset classes. These vehicles provide diversification and can be used to implement various investment strategies.

Frequently Asked Questions

What are the key principles of investing?

The key principles of investing include understanding your financial goals, risk tolerance, and time horizon. It’s essential to diversify your portfolio, invest for the long term, and avoid emotional decisions based on market volatility. Additionally, having a clear investment strategy and regularly reviewing your portfolio can help you achieve your financial objectives.

How do I get started with investing?

To get started with investing, begin by setting clear financial goals and assessing your risk tolerance. Open a brokerage account or consider a robo-advisor if you’re new to investing. Fund your account and start with a diversified portfolio, such as a total stock market index fund or a balanced ETF. You can also take advantage of tax-advantaged accounts like 401(k) or IRA.

What is the difference between stocks and bonds?

Stocks represent ownership in companies, offering potential for long-term growth, but come with higher volatility. Bonds are debt securities issued by companies or governments, providing regular income and relatively lower risk. Stocks are generally considered higher-risk, higher-reward investments, while bonds are often seen as more conservative, income-generating investments.

How much should I invest each month?

The amount you should invest each month depends on your income, expenses, and financial goals. Aim to invest a fixed percentage of your income, such as 10% to 20%, and adjust as needed. Consider setting up a systematic investment plan to transfer funds regularly into your investment account, taking advantage of dollar-cost averaging and reducing the impact of market fluctuations.

How to Build a Portfolio

How to Build a Portfolio