Saving money is a crucial aspect of personal finance that can significantly impact one’s financial stability and security. With the rising costs of living and increasing financial demands, it has become more challenging for individuals to manage their expenses effectively. Implementing effective money-saving strategies can help individuals achieve their financial goals, reduce debt, and build a safety net for unexpected expenses. By adopting simple and practical tips, individuals can develop healthy financial habits and make significant progress towards securing their financial future. Effective money management is within reach.

Effective Strategies for Saving Money

Saving money is a crucial aspect of financial planning, and there are several strategies that can help individuals achieve their financial goals. By implementing the right techniques, individuals can reduce unnecessary expenses, build wealth, and secure their financial future. The key is to be consistent, patient, and informed about the best practices for saving money.

Creating a Budget

Creating a budget is the first step towards saving money. It involves tracking income and expenses to understand where the money is going and identifying areas where costs can be cut. A well-crafted budget should account for all necessary expenses, such as rent, utilities, and groceries, as well as allocate funds for savings and emergency funds. By having a clear picture of their financial situation, individuals can make informed decisions about how to manage their money effectively. A good budget should be realistic, flexible, and regularly reviewed.

Budgeting Tools Comparison

Budgeting Tools ComparisonCutting Unnecessary Expenses

Cutting unnecessary expenses is another effective way to save money. This can be achieved by identifying areas of wastage and making adjustments to daily habits. For instance, individuals can save money by cooking at home instead of eating out, canceling subscription services that are not used, and reducing energy consumption. By being mindful of their spending habits, individuals can significantly reduce their expenses and allocate the saved funds towards their savings goals.

Automating Savings

Automating savings is a great way to ensure that individuals save money consistently. This can be achieved by setting up automatic transfers from a checking account to a savings account. By doing so, individuals can make saving a habit and reduce the likelihood of spending money impulsively. Automating savings also helps to take advantage of the power of compounding, where savings can grow over time.

| Saving Strategy | Description | Benefits |

|---|---|---|

| Budgeting | Tracking income and expenses to understand where the money is going | Helps identify areas for cost-cutting, makes saving a priority |

| Cutting Expenses | Identifying and reducing unnecessary expenses | Saves money, reduces waste, promotes financial discipline |

| Automating Savings | Setting up automatic transfers to a savings account | Makes saving a habit, takes advantage of compounding, reduces impulsive spending |

Frequently Asked Questions

What are some effective ways to start saving money?

To start saving money, begin by tracking your expenses to understand where your money is going. Create a budget that accounts for all necessary expenses, and then identify areas where you can cut back. Set financial goals, such as saving for a emergency fund or paying off debt. Automate your savings by setting up automatic transfers from your checking account.

Emergency Fund Importance

Emergency Fund ImportanceHow can I reduce my daily expenses to save more?

Reducing daily expenses can be achieved by making small changes to your habits. Bring your lunch to work instead of buying it, cancel subscription services you don’t use, and look for discounts or promotions. Use cashback or rewards credit cards for daily purchases. Avoid impulse buys and shop during sales. By making these changes, you can save a significant amount over time.

What are some strategies for saving money on large purchases?

To save money on large purchases, research and compare prices across different retailers. Look for discounts, coupons, or promo codes that can be used. Consider buying last year’s model or a refurbished item. Use price tracking tools to monitor price changes and buy when the price is lowest. Negotiate the price if possible, and consider financing options with low or no interest.

How can I stay motivated to continue saving money?

Staying motivated to save money requires setting clear financial goals and tracking progress. Celebrate small victories along the way, such as reaching a savings milestone. Visualize the benefits of saving, such as financial security or achieving a long-term goal. Share your goals with a friend or family member to increase accountability. Review and adjust your budget regularly to stay on track.

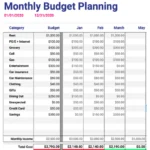

Creating a Monthly Budget

Creating a Monthly Budget