Having a financial safety net is crucial in today’s uncertain world. An emergency fund serves as a protective barrier against unexpected expenses, job loss, or medical emergencies, helping individuals avoid debt and financial strain. The importance of maintaining an easily accessible savings account cannot be overstated, as it provides peace of mind and financial stability. By setting aside a portion of their income, individuals can ensure they are better equipped to handle life’s unexpected events, thereby safeguarding their financial well-being and long-term goals. A well-planned emergency fund is a vital component of a comprehensive financial strategy.

Why Having an Emergency Fund is Crucial for Financial Stability

Having an emergency fund is a vital component of a comprehensive financial plan. It serves as a safety net to cover unexpected expenses, ensuring that you don’t go into debt or compromise your long-term financial goals when unforeseen events occur. An emergency fund provides peace of mind and financial stability, allowing you to navigate life’s uncertainties with confidence.

Protecting Against Financial Shocks

An emergency fund acts as a buffer against financial shocks, such as car repairs, medical bills, or losing a job. By having a readily available pool of funds, you can avoid dipping into your savings or retirement accounts, or worse, going into debt to cover these unexpected expenses. This helps to prevent a ripple effect on your overall financial health, keeping you on track with your financial objectives.

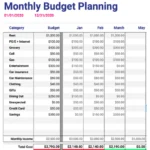

Creating a Monthly Budget

Creating a Monthly BudgetDetermining the Right Size for Your Emergency Fund

The ideal size of an emergency fund varies based on individual circumstances, including income, expenses, job security, and dependents. A general rule of thumb is to save three to six months’ worth of living expenses. However, this can be adjusted based on factors such as job stability, health, and other sources of support. It’s essential to assess your personal situation to determine the right amount for your emergency fund.

Strategies for Building Your Emergency Fund

Building an emergency fund requires discipline and a well-thought-out strategy. Start by assessing your monthly expenses to determine how much you need to save. Set up a separate savings account specifically for your emergency fund and automate your savings through regular transfers. Consider taking advantage of high-yield savings accounts or other liquid, low-risk investment options to grow your fund over time.

| Emergency Fund Considerations | Description |

|---|---|

| Monthly Expenses | Calculate your essential expenses to determine your emergency fund needs. |

| Job Security | Consider your job stability and industry volatility when deciding on the size of your emergency fund. |

| Dependents | Take into account the number of dependents you have and their financial needs. |

| Liquid Savings Options | Explore high-yield savings accounts or other liquid, low-risk investments for your emergency fund. |

Frequently Asked Questions

What is an emergency fund?

An emergency fund is a pool of money set aside to cover unexpected expenses or financial shortfalls. It serves as a financial safety net, helping individuals avoid debt and financial stress when unexpected events occur, such as car repairs, medical bills, or losing a job. The fund is typically held in a liquid, low-risk account.

Why is having an emergency fund important?

Having an emergency fund is crucial because it provides financial stability and peace of mind. It helps individuals avoid going into debt when unexpected expenses arise, and it can also help them avoid dipping into long-term investments or retirement savings. By having a cushion in place, individuals can better navigate financial shocks and stay on track with their long-term financial goals.

How much should I save in an emergency fund?

The amount to save in an emergency fund varies based on individual circumstances, but a common rule of thumb is to save three to six months’ worth of living expenses. This amount can provide a sufficient cushion to cover essential expenses in case of a job loss, medical emergency, or other unexpected events. The key is to save enough to feel secure and avoid financial stress.

Where should I keep my emergency fund?

It’s best to keep an emergency fund in a liquid, low-risk account that is easily accessible, such as a high-yield savings account or a money market fund. These types of accounts typically offer competitive interest rates and allow for quick withdrawals when needed. Avoid investing emergency funds in volatile assets, as the goal is to preserve capital, not to grow it.

Tips for Saving Money

Tips for Saving Money