Managing personal finances effectively is crucial for achieving financial stability and security. One of the most effective ways to take control of your financial situation is by creating a monthly budget. A well-structured budget enables you to track your income and expenses, identify areas of unnecessary expenditure, and make informed decisions about how to allocate your resources. By doing so, you can prioritize your spending, reduce debt, and work towards your long-term financial goals. Establishing a monthly budget is a straightforward yet powerful tool for gaining control over your financial health and building a more secure financial future.

Creating a Monthly Budget: A Step-by-Step Guide

Creating a monthly budget is an essential step in managing your finances effectively. It involves tracking your income and expenses to ensure you’re living within your means and making progress towards your financial goals. To create a monthly budget, you need to start by identifying your income sources and fixed expenses, such as rent, utilities, and groceries.

Identifying Income and Fixed Expenses

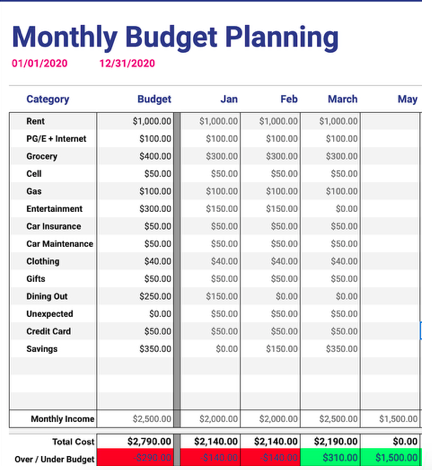

The first step in creating a monthly budget is to identify your income sources and fixed expenses. This includes your salary, investments, and any other regular income, as well as expenses like rent, utilities, and minimum payments on debts. It’s essential to be accurate when calculating your income and fixed expenses, as this will form the foundation of your budget. You can use a spreadsheet or a budgeting app to make it easier to track and categorize your income and expenses. For instance, you can use a table like the one below to get started:

| Income Sources | Monthly Amount |

|---|---|

| Salary | $4,000 |

| Investments | $500 |

| Total Income | $4,500 |

Categorizing Expenses

Once you have identified your income and fixed expenses, the next step is to categorize your expenses into different segments, such as housing, transportation, food, entertainment, and savings. This will help you understand where your money is going and identify areas where you can cut back. You can use the 50/30/20 rule as a guideline, where 50% of your income goes towards fixed expenses, 30% towards discretionary spending, and 20% towards saving and debt repayment. For example, you can allocate your income into different categories as shown below:

| Expense Category | Monthly Amount | Percentage of Income |

|---|---|---|

| Housing | $1,500 | 33% |

| Transportation | $500 | 11% |

| Food | $800 | 18% |

| Total Expenses | $4,300 | 96% |

Adjusting and Refining Your Budget

After categorizing your expenses, you may need to adjust and refine your budget to ensure it’s realistic and achievable. This involves reviewing your budget regularly to identify areas where you can cut back and make adjustments as needed. You can also use tools like budgeting apps or spreadsheets to track your expenses and stay on top of your finances. By regularly reviewing and adjusting your budget, you can stay on track with your financial goals and make progress towards achieving financial stability. A sample budget adjustment plan can be seen below:

| Budget Category | Original Budget | Adjusted Budget |

|---|---|---|

| Entertainment | $500 | $300 |

| Savings | $200 | $400 |

| Total Changes | $200 increase in savings |

Effective Strategies for Creating a Monthly Budget

Creating a monthly budget is a crucial step in managing one’s finances effectively, as it allows individuals to track their income and expenses, identify areas of unnecessary spending, and make informed decisions about how to allocate their resources in a way that aligns with their financial goals.

Assessing Your Financial Situation

To create a realistic and effective monthly budget, it’s essential to start by assessing your current financial situation, including your income, fixed expenses, and debt obligations, as well as any financial goals you may have, such as saving for a big purchase or paying off high-interest debt.

Categorizing Your Expenses

Categorizing your expenses into different groups, such as housing, transportation, and entertainment, can help you understand where your money is going and identify areas where you may be able to cut back and allocate your resources more efficiently.

Setting Financial Goals

Setting clear and achievable financial goals is a critical component of creating a successful monthly budget, as it provides a sense of direction and motivation, and helps guide your decisions about how to allocate your resources.

Prioritizing Needs Over Wants

When creating a monthly budget, it’s essential to prioritize your needs over your wants, ensuring that you’re allocating sufficient resources to cover essential expenses, such as rent/mortgage and utilities, before spending on discretionary items.

Tips for Saving Money

Tips for Saving MoneyMonitoring and Adjusting Your Budget

To ensure that your monthly budget remains effective over time, it’s crucial to regularly monitor your spending and make adjustments as needed, taking into account any changes in your income, expenses, or financial goals.

Frequently Asked Questions

What is the first step in creating a monthly budget?

The first step in creating a monthly budget is to track your income and expenses. Start by gathering financial documents, such as pay stubs and bills, to understand where your money is coming from and where it’s being spent. This will help you identify areas for improvement and make informed decisions about your financial resources.

How do I categorize my expenses when creating a monthly budget?

When creating a monthly budget, categorize your expenses into needs, wants, and debt repayment. Needs include essential expenses like rent, utilities, and groceries. Wants are discretionary expenses, such as entertainment and hobbies. Debt repayment includes payments on loans and credit cards. This categorization will help you prioritize your spending and make adjustments as needed.

What is the 50/30/20 rule in budgeting?

The 50/30/20 rule is a guideline for allocating your income towards different expense categories. Allocate 50% of your income towards necessary expenses, such as rent and utilities. Use 30% for discretionary spending, like entertainment and hobbies. Put 20% towards saving and debt repayment. This rule helps you strike a balance between enjoying your life today and securing your financial future.

How often should I review and adjust my monthly budget?

Review and adjust your monthly budget regularly to ensure you’re on track with your financial goals. Ideally, review your budget at the end of each month to account for any changes in income or expenses. Make adjustments as needed to stay on course and make progress towards your financial objectives. Regular reviews will help you stay focused and motivated.

Budgeting Tools Comparison

Budgeting Tools Comparison