Managing personal finances effectively is crucial in today’s economic landscape. With numerous expenses, income sources, and financial goals to track, individuals need reliable tools to stay on top of their monetary situation. Budgeting tools have emerged as a vital resource, offering a range of features to simplify financial management. This article compares various budgeting tools, examining their key features, pricing, and usability to help users make an informed decision when selecting the most suitable tool for their financial needs and preferences, ensuring a more organized and stress-free financial life.

Comparing the Best Budgeting Tools for Personal Finance Management

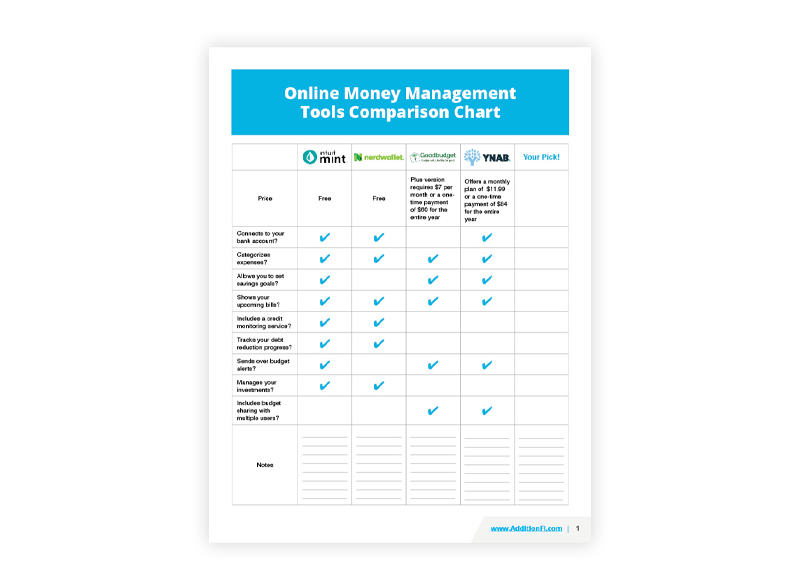

When it comes to managing personal finances effectively, utilizing the right budgeting tool can make a significant difference. With numerous options available in the market, comparing these tools based on their features, ease of use, and cost is essential for making an informed decision. A good budgeting tool should not only help in tracking expenses and income but also provide insights into spending habits and offer suggestions for improvement.

Key Features to Consider in Budgeting Tools

The effectiveness of a budgeting tool largely depends on its features. Automated expense tracking and the ability to categorize expenses are crucial for understanding where your money is going. Additionally, tools that offer bill tracking and reminders can help ensure that you never miss a payment. Some advanced tools also provide investment tracking and financial goal setting features, making them a comprehensive solution for personal finance management.

Emergency Fund Importance

Emergency Fund ImportanceCost and Pricing Models of Budgeting Tools

The cost of budgeting tools can vary significantly, ranging from free versions with basic features to premium subscriptions that offer advanced functionalities. It’s essential to consider the pricing model and whether it aligns with your budget. Some tools operate on a freemium model, offering basic features for free and charging for premium services. Understanding the cost and what you get in return is vital for choosing a tool that fits your financial situation.

User Experience and Integration Capabilities

The user experience of a budgeting tool can greatly impact its effectiveness. A tool with an intuitive interface and clear navigation makes it easier to track your finances regularly. Moreover, the ability of a budgeting tool to integrate with other financial accounts and services enhances its utility by providing a holistic view of your financial situation.

| Tool | Key Features | Pricing | User Experience |

|---|---|---|---|

| Mint | Automated expense tracking, Bill tracking | Free | User-friendly interface, Multi-account linking |

| Personal Capital | Investment tracking, Financial planning | Free | Comprehensive financial overview, Secure data encryption |

| YNAB (You Need a Budget) | Proactive budgeting, Goal setting | $6.99/month or $83.99/year | Educational resources, Simple and intuitive |

Frequently Asked Questions

What are the key features to consider when comparing budgeting tools?

When comparing budgeting tools, consider features such as user interface, expense tracking, budgeting categories, investment tracking, bill tracking, and alerts. Also, look for tools that offer automatic transaction syncing, secure data storage, and mobile accessibility. Some tools may also offer additional features like financial goal setting, credit score monitoring, and investment advice.

Creating a Monthly Budget

Creating a Monthly BudgetHow do budgeting tools handle security and data protection?

Reputable budgeting tools prioritize security and data protection by using robust encryption, two-factor authentication, and secure servers. They also comply with financial industry standards and regulations. Users should review a tool’s security measures, such as data storage practices and access controls, to ensure their financial information is protected.

Can budgeting tools help with financial goal setting and tracking?

Yes, many budgeting tools offer features that help users set and track financial goals, such as saving for a specific purpose or paying off debt. These tools allow users to set targets, track progress, and receive notifications when they’re nearing their goals. Some tools also provide personalized recommendations to help users achieve their financial objectives.

Are there free budgeting tools available, or do they all require a subscription?

There are both free and paid budgeting tools available. Some tools offer a basic free version with limited features, while others provide a free trial before requiring a subscription. Paid tools often offer more advanced features, such as investment tracking or financial planning, and may offer different pricing tiers to suit various user needs.