Bank fees are a ubiquitous aspect of modern banking, affecting millions of consumers worldwide. These charges can be incurred for a variety of services, from maintaining accounts to conducting transactions. Understanding bank fees is essential for managing personal finances effectively and avoiding unnecessary expenses. The complexity and diversity of fees can be overwhelming, making it challenging for consumers to navigate their bank’s fee structure. By grasping the different types of bank fees and their implications, individuals can make informed decisions about their banking choices and potentially save money.

Understanding Bank Fees: A Comprehensive Guide

Bank fees are charges levied by financial institutions on their customers for various services. These fees can be a significant expense for individuals and businesses alike, and understanding them is crucial for managing one’s finances effectively. Bank fees can vary widely depending on the type of account, the services used, and the bank’s policies.

Types of Bank Fees

Banks charge a range of fees for different services, including maintenance fees, overdraft fees, and ATM fees. Maintenance fees are charged for services such as account maintenance, while overdraft fees are incurred when a customer spends more than they have in their account. ATM fees, on the other hand, are charged when a customer uses an out-of-network ATM.

Benefits of Online Banking

Benefits of Online BankingFactors Affecting Bank Fees

The amount of bank fees charged can depend on several factors, including the type of account, the customer’s usage patterns, and the bank’s fee structure. For example, some banks may charge higher fees for premium services such as expedited payment processing or wire transfers. Understanding these factors can help customers minimize their bank fees.

Avoiding Bank Fees

There are several strategies that customers can use to avoid or minimize bank fees. One approach is to choose a bank with a low-fee or no-fee account. Another is to be mindful of one’s account balance and avoid overdrafts. Customers can also use in-network ATMs to avoid ATM fees.

| Fee Type | Description | Average Fee Amount |

|---|---|---|

| Overdraft Fee | Charged when a customer spends more than they have in their account | $30-$35 |

| ATM Fee | Charged when a customer uses an out-of-network ATM | $2-$5 |

| Maintenance Fee | Charged for account maintenance services | $5-$15 |

Frequently Asked Questions

What are bank fees?

Bank fees are charges levied by financial institutions for various services, including account maintenance, transactions, and overdrafts. These fees can vary depending on the bank, account type, and services used. Understanding bank fees is essential to manage your finances effectively and avoid unnecessary charges.

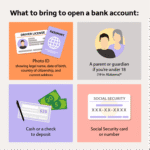

How to Open a Checking Account

How to Open a Checking AccountHow can I avoid bank fees?

To avoid bank fees, maintain minimum balance requirements, use in-network ATMs, and set up direct deposit. You can also consider switching to a bank or credit union with lower or no fees. Regularly reviewing your account statements and terms can help you identify potential fees and take steps to minimize them.

What are the most common types of bank fees?

Common bank fees include monthly maintenance fees, overdraft fees, ATM fees, and late payment fees. Other fees may be associated with services like wire transfers, account closures, or paper statements. Being aware of these fees can help you manage your account and make informed decisions about your banking.

Can I negotiate bank fees with my bank?

Yes, you can negotiate bank fees with your bank. If you’re a long-time customer or have a significant balance, you may be able to waive or reduce certain fees. Contacting your bank’s customer service department and politely requesting a fee waiver or reduction can be effective. Be prepared to explain your situation and provide context to support your request.

Safe Banking Practices

Safe Banking Practices