Opening a checking account is a fundamental step in managing personal finances effectively. It provides a secure way to store money, make transactions, and track expenses. With numerous banking options available, choosing the right checking account can be overwhelming. This article will guide you through the process of opening a checking account, including the necessary documents, types of accounts, and factors to consider when selecting a bank. By understanding the steps involved, individuals can make informed decisions and successfully open a checking account that meets their financial needs. A checking account is a essential financial tool.

Opening a Checking Account: A Step-by-Step Guide

Opening a checking account is a crucial step in managing your finances effectively. It allows you to keep your money safe, make transactions easily, and track your expenses. To open a checking account, you will typically need to provide some personal and financial information, and then fund the account.

Choosing the Right Bank

When it comes to opening a checking account, the first step is to choose a bank that meets your needs. You should consider factors such as fees associated with the account, minimum balance requirements, online banking services, and mobile banking apps. You can research different banks online, read reviews, and compare their offerings to find the best fit for you.

Safe Banking Practices

Safe Banking PracticesGathering Required Documents

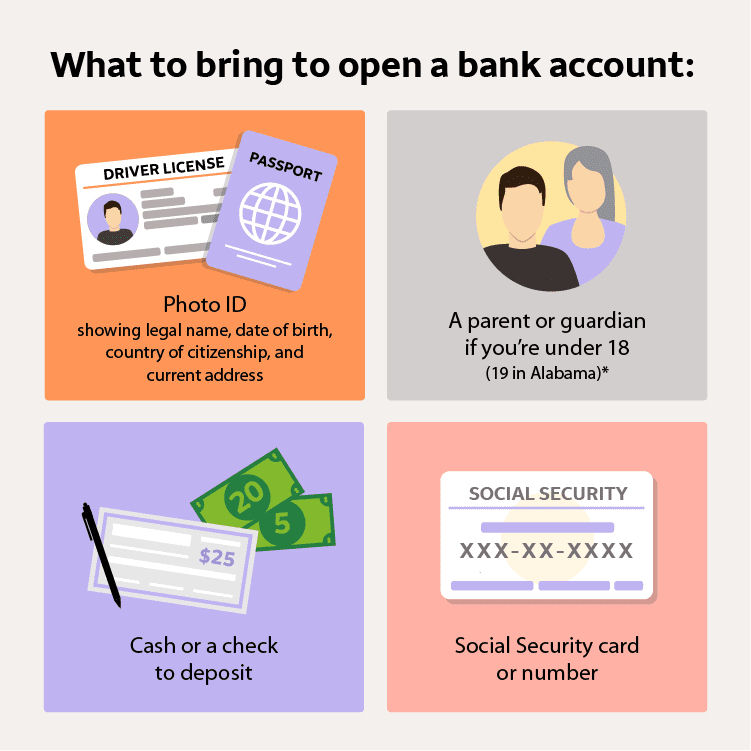

To open a checking account, you will typically need to provide some personal identification and financial information. This may include a valid government-issued ID, proof of address, and Social Security number or Individual Taxpayer Identification Number (ITIN). You should also be prepared to provide information about your employment and income.

Funding Your New Account

Once you have chosen a bank and gathered the required documents, you will need to fund your new account. You can do this by making an initial deposit, which can be done with cash, a transfer from an existing account, or a direct deposit. The minimum amount required to open an account varies by bank, so be sure to check with your chosen bank.

| Required Documents | Description |

|---|---|

| Valid Government-Issued ID | A driver’s license, passport, or state ID |

| Proof of Address | A utility bill, lease agreement, or bank statement |

| Social Security Number or ITIN | A Social Security number or Individual Taxpayer Identification Number |

Frequently Asked Questions

What are the basic requirements to open a checking account?

To open a checking account, you typically need to provide identification, proof of address, and your Social Security number. You may also need to make an initial deposit, which can vary depending on the bank. Some banks may have additional requirements, so it’s best to check with the bank directly to confirm their specific requirements.

Choosing the Right Bank

Choosing the Right BankCan I open a checking account online?

Yes, many banks allow you to open a checking account online. You can visit the bank’s website, fill out the application, and upload the required documents. Some banks may also offer mobile banking apps that enable you to open an account using your mobile device. The process is usually straightforward and can be completed within a few minutes.

What are the benefits of having a checking account?

Having a checking account offers several benefits, including the ability to manage your finances effectively, make transactions easily, and access your money when needed. You can also use a checking account to pay bills, receive direct deposits, and track your expenses. Additionally, many checking accounts come with debit cards and online banking services.

How long does it take to open a checking account?

The time it takes to open a checking account can vary depending on the bank and the method you choose. If you apply online, the process can be completed within a few minutes. However, if you need to visit a branch or wait for the bank to verify your information, it may take a few days. Some banks may also offer instant account opening, allowing you to start using your account immediately.

Understanding Bank Fees

Understanding Bank Fees