Selecting a bank that aligns with your financial needs is a critical decision that can significantly impact your financial health. With numerous banking institutions offering a wide array of services, the task of choosing the right one can be daunting. Factors such as service fees, interest rates, mobile banking capabilities, and customer service quality play a crucial role in this decision-making process. Understanding your banking needs and carefully evaluating the offerings of different banks is essential to making an informed choice. A well-chosen bank can simplify financial management.

Choosing the Right Bank for Your Financial Needs

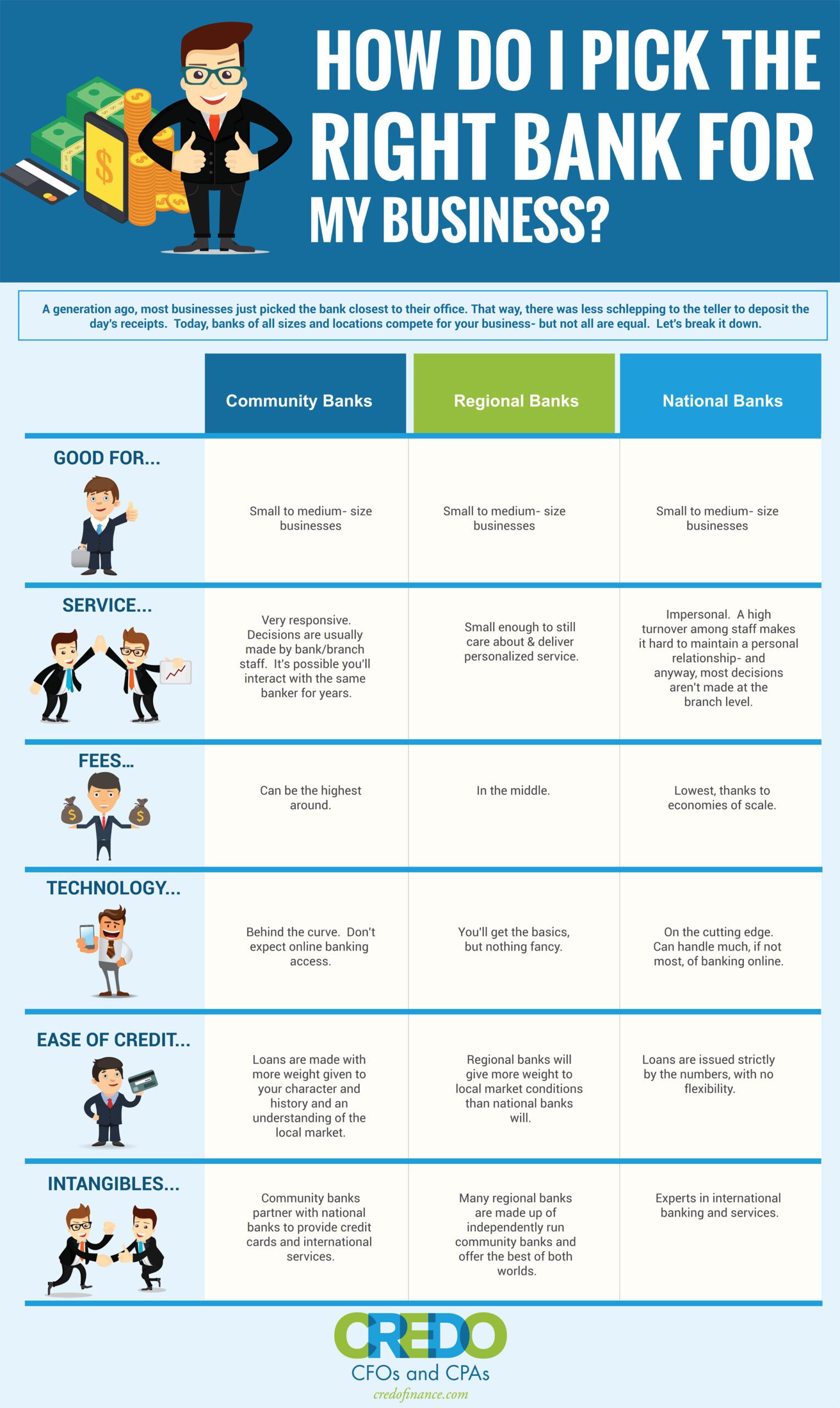

Choosing the right bank is a crucial decision that can significantly impact your financial health and stability. With numerous banking institutions offering a wide array of services, it’s essential to carefully evaluate your options to select a bank that aligns with your financial goals and needs. The process involves considering various factors, including the types of accounts offered, fees associated with banking services, the quality of customer service, and the bank’s technological capabilities.

Assessing Banking Services and Fees

When selecting a bank, one of the primary considerations is the range of services it offers and the associated fees. Different banks provide various types of accounts, such as checking and savings accounts, credit cards, loans, and investment services. It’s crucial to assess the fees associated with these services, including maintenance fees, overdraft fees, ATM fees, and interest rates on loans and credit cards. Understanding these fees can help you avoid unexpected charges and save money.

Understanding Bank Fees

Understanding Bank FeesEvaluating Customer Service and Support

The quality of customer service is another vital factor to consider when choosing a bank. You want a bank that offers reliable and accessible customer support, whether through online chat, phone, or in-person at a branch. A bank with a strong customer service reputation can make a significant difference in your banking experience, especially if you encounter any issues or have questions about their services.

Considering Digital Banking Capabilities

In today’s digital age, a bank’s technological capabilities are increasingly important. You should look for a bank that offers robust online banking and mobile banking apps, allowing you to manage your accounts, transfer funds, and pay bills conveniently. The security of these digital platforms is also paramount, so it’s essential to choose a bank that prioritizes cybersecurity and data protection.

| Banking Feature | Description | Importance Level |

|---|---|---|

| Online Banking | Access to account management and transactions online | High |

| Mobile Banking App | Ability to manage accounts and conduct transactions via mobile device | High |

| Customer Service | Availability of support through various channels (phone, email, chat) | High |

| Fee Structure | Transparency and reasonableness of fees for services | Medium |

| Branch and ATM Network | Convenience and accessibility of physical banking locations and ATMs | Medium |

| Security Measures | Implementation of robust security protocols to protect customer data | High |

Frequently Asked Questions

What factors should I consider when choosing a bank?

When choosing a bank, consider factors such as fees, interest rates, branch and ATM locations, mobile banking services, and customer support. You should also think about the type of accounts and services you need, such as checking and savings accounts, credit cards, and loans. Researching and comparing these factors can help you find a bank that meets your financial needs.

Benefits of Online Banking

Benefits of Online BankingHow do I know if a bank is secure and reliable?

To determine if a bank is secure and reliable, look for banks that are insured by a government agency, such as the Federal Deposit Insurance Corporation (FDIC) in the US. You can also check the bank’s ratings and reviews from reputable sources, such as Bankrate or Consumer Reports. Additionally, research the bank’s history, financial stability, and security measures to ensure your deposits are protected.

What are the benefits of online banking versus traditional banking?

Online banking offers convenience, flexibility, and often lower fees compared to traditional banking. You can access your accounts and conduct transactions online or through mobile apps, 24/7. Traditional banking, on the other hand, provides face-to-face interaction and personalized service. Consider your banking needs and preferences to decide which type of banking is best for you.

Can I switch banks easily if I’m not satisfied with my current bank?

Yes, you can switch banks if you’re not satisfied with your current bank. To do so, you’ll need to open a new account, transfer your funds, and update your automatic payments and direct deposits. It’s also a good idea to review your new bank’s fees, services, and policies to ensure they meet your needs. Switching banks can be a straightforward process if you plan ahead and take the necessary steps.

How to Open a Checking Account

How to Open a Checking Account