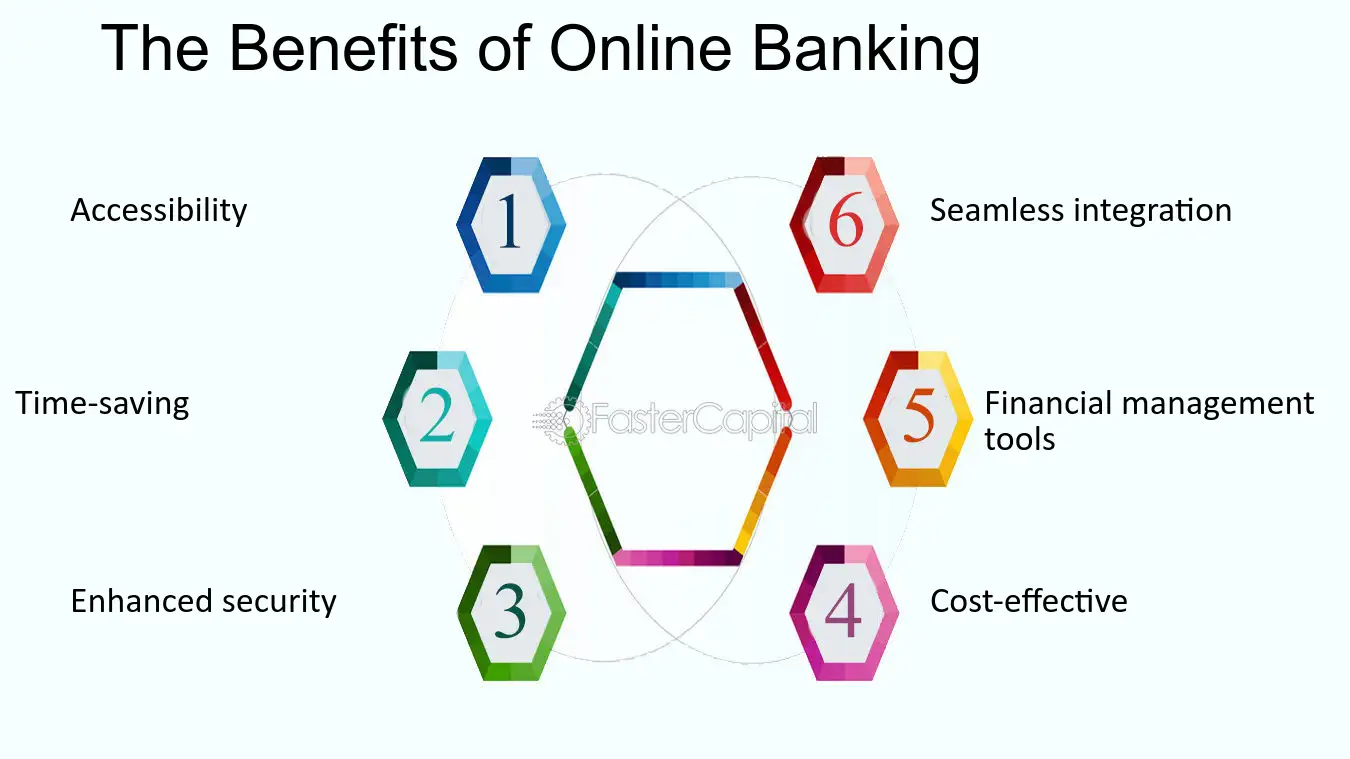

The advent of online banking has revolutionized the way people manage their finances, offering a convenient and secure way to conduct transactions. With the rise of digital technology, online banking has become increasingly popular, providing users with a range of benefits that traditional banking methods cannot match. From saving time and increasing accessibility to reducing costs and enhancing security, online banking has transformed the banking experience. This article will explore the key benefits of online banking, highlighting its advantages and how it can improve financial management for individuals and businesses alike, making it an essential tool in today’s digital age.

Benefits of Managing Your Finances Online

Online banking has revolutionized the way we manage our finances, offering a plethora of benefits that traditional banking methods cannot match. With the rise of digital banking, customers can now perform a wide range of financial transactions from the comfort of their own homes, or on-the-go using their mobile devices.

Convenience and Accessibility

One of the most significant advantages of online banking is the convenience it offers. With online banking, you can access your account information, transfer funds, and pay bills at any time, 24/7, as long as you have a stable internet connection. This means you can manage your finances at a time that suits you, without having to adhere to traditional banking hours.

How to Open a Checking Account

How to Open a Checking AccountTime and Cost Savings

Online banking also helps you save time and reduce costs. By automating tasks such as bill payments and fund transfers, you can free up more time to focus on other important tasks. Additionally, online banking can help you avoid the costs associated with traditional banking methods, such as late payment fees and overdraft charges.

Enhanced Security and Control

Online banking provides enhanced security features, such as two-factor authentication and real-time transaction monitoring, to help protect your account from unauthorized access and suspicious activity. You can also track your account activity in real-time, allowing you to quickly identify and report any discrepancies.

| Benefits | Description |

|---|---|

| 24/7 Access | Manage your finances at any time, from anywhere with an internet connection. |

| Automated Transactions | Set up recurring payments and transfers to save time and reduce errors. |

| Real-time Updates | Track your account activity in real-time, allowing you to quickly identify and report any discrepancies. |

Frequently Asked Questions

What are the main benefits of online banking?

Online banking offers numerous benefits, including convenience, flexibility, and accessibility. With online banking, you can manage your accounts, pay bills, and transfer funds from anywhere, at any time. This saves you time and effort, and reduces the need to visit a physical bank branch. You can also monitor your account activity and track your expenses more effectively.

Safe Banking Practices

Safe Banking PracticesIs online banking secure?

Online banking is generally secure, as banks use advanced security measures such as encryption, firewalls, and two-factor authentication to protect your data. Additionally, most banks have robust security protocols in place to detect and prevent suspicious activity. However, it’s still essential to take precautions, such as using strong passwords and keeping your software up to date.

Can I access my account information at any time?

Yes, with online banking, you can access your account information 24/7. You can view your account balances, transaction history, and statements, as well as manage your accounts and pay bills. This allows you to stay on top of your finances and make informed decisions about your money.

How can online banking help me save money?

Online banking can help you save money by reducing the need for paper statements and other paperwork. You can also take advantage of online banking tools, such as budgeting and expense tracking, to better manage your finances. Additionally, many banks offer online banking services with lower fees and higher interest rates, helping you save money over time.

Choosing the Right Bank

Choosing the Right Bank